Ask the Hammer

In 2005 the Feds tasked 2 professors [Carol Rogerson (University of Toronto Faculty of Law) and Rollie Thompson (Dalhousie University)] to prepare guidelines to determine levels of spousal support that could be payable under certain scenarios.

Practical Case/Formula

(From the Spousal Support Advisory Guidelines Report)

To determine the amount of support to be paid (without child support):

- Determine the gross income difference between the couple:

Spouse’s revenue –less– Your Revenue =

($ gross income difference)

- Determine the applicable percentage by multiplying the length of the marriage by 1.5% – 2 % per year:

1.5% x number ___ of years of marriage = ___ percent

to

2% x number ___ of years of marriage = ___ percent

- Apply the applicable percentage to the income difference obtained per #1 above.

___% x ($ gross income difference) = support per year $_________ (per month (÷ 12) = $__________).

to

___% x ($ gross income difference) = support per year $_________ (per month (÷ 12) = $__________).

Duration would be indefinite if the length of the marriage was 20 years or more.

Without describing all such scenarios, the guidelines consider the following criteria:

- Length of marriage.

- With and without children.

- Property division upon divorce.

- Remarriage, second families.

A final report was presented in 2008 after consultations across the country were conducted.

Obviously, subsequent legislation and Supreme Court cases (such as Contino vs. Contino in 2005 which set out the approach to determine child support under shared custodial situations) impact the guidelines which, in any event, remain but advisory as they are not law. However, several provinces, including Quebec, may use the guidelines both in negotiations and in arguments at Court. Note that our Quebec Court of Appeal specifically ruled the guidelines to be non-binding. This does not rule out their use as a tool, amongst others, to factor into solutions in divorce cases under the Federal Divorce Act and Judges may base decisions on the guidelines. It is also advisable to verify each Province’s use of these guidelines and to consult an attorney to ensure you have in fact a claim/obligation vis-à-vis spousal support. Also of importance is the fact that child support, from sea to shining sea, is determined prior to determining whether spousal support is due, and in Quebec, on the merits of a divorce, spousal support is assessed after property division has been decided since the values of same and the revenues which may flow from them impact support determination.

It is important, critical actually, to remember that nothing is ever set in stone in a courtroom and many factors, other legislation and yes, biases, play a role in the outcomes of each case.

You will find one of two (2) basic formulas here to entertain you [from Section 7.3 of the Spousal Support Advisory Guidelines which can be found on the GOVERNMENT OF CANADA Department of Justice website at: www.justice.gc.ca under Spousal Support Advisory Guidelines. Even if you are happily married, proceeding with these calculations can be an eye opener. And if you don’t have the revenue information of your spouse, you already have a problem! This information (the real information, not simply what tax savvy advisors input on tax returns) should be freely exchanged between couples. If your spouse is hiding the real numbers, then you have a real problem and should address it directly, soon rather than later.

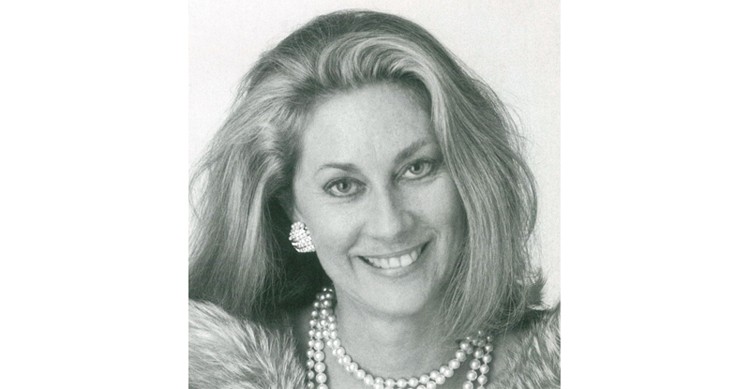

© 2017 Linda Hammerschmid