Managing Your Money

Managing Your Money

By 2026, women are expected to control half of Canada’s household wealth. Are we ready?

We’ve all heard the expression “women are a force to be reckoned with.” That is increasingly true in investing where women are emerging as a dominant market. By 2026 women in Canada are expected to control about 50% of the nation’s wealth!1

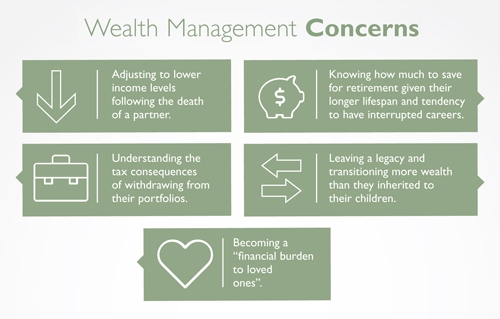

Women’s Wealth Management Concerns

Image: Strategic Insight. 2017

Women’s rising economic power is one of the most significant economic shifts in recent decades. But is the wealth management industry ready? In this three-part series about ‘Women and Wealth’, we will address why women’s share of wealth has increased, how women’s financial needs differ, and why the wealth management industry may not be prepared for this transition.

Understanding these trends is crucial. Nearly 90% of women will be sole financial decision makers at some point in their lives.2 To help them, we will suggest steps that women investors can take to ease the transition.

Women: significant power and dominance

Women began increasing their financial power slowly but surely decades ago as they began to flow into the labor force. However, that pace has accelerated rapidly. Today, women are the leading holders of post-secondary degrees3 and thus increasingly performing higher value-added and better paying tasks. Women are also starting and running new businesses at a rapid rate.

“Nearly 90% of women will be sole financial decision makers at some point in their lives.”

Women are also benefitting from significant wealth transfers through inheritances, either from parents or spouses, in part because they generally marry older men and live longer than their partners. This shows up dramatically in the numbers. For every 4 widows in Canada over 65, there is only one widower.4 Furthermore, more than 10% of women in Canada are divorced or separated2 and, in many cases, have received a transfer of wealth which they now control.

Women want investments to connect with core values

The famous 1990s book Men Are from Mars, Women Are from Venus pleasantly illustrates how men’s and women’s emotional needs, communication styles, and fundamental psychology differ. Increasingly research is being done on what differentiates men from women when it comes to money as well. Anecdotal observation suggests that money is an emotional subject for women, tied to safety, security, freedom, and independence.

“Attracting more women to the financial industry would play a major role in better addressing their needs.”

Women want to talk about money matters in more grounded ways. They want to connect money and investing to their lives. They see money as a means to many ends, not an end in itself. Women want a view on how certain issues will affect their finances and their lives – outliving their partner, divorce, health issues, helping their children, are key issues they want to address. Women want to factor non-financial concerns into their financial plans, because many of these concerns are actually connected to money.

Women’s Wealth Management Wants

Image: Strategic Insight. 2017

Women also want investments that reflect their core values. In fact, many women see impact investing* as a form of giving, and therefore want those two goals to be aligned. Women recognize that their investments are a powerful way to benefit their community or society as a whole – by promoting gender equality, children’s welfare, health, or environmental issues.

Men tend to focus more on investment performance. Those who are more competitive, want to know if their portfolio outperformed others. In a survey5 by Boston Consulting Group, 96% of men said they invest to increase their income, and base investment decisions on an asset’s track record for growth and yield.

Fewer women have a financial plan

While men and women share many needs, such as being able to retire or to sustain income, women want personalized planning and investment solutions that are tailored for their unique situations. This is particularly true in cases when the possibility of becoming suddenly single, through death or divorce, is high. Women generally want plans that focus on meeting their financial goals, and which reflect both investment performance and their personal values.

Yet ironically, while research suggests that women place a greater level of importance on financial matters than men, fewer women than men actually have a financial plan.6

Part of that relates to the fact that many women are still not yet fully cognizant of their growing financial clout. I always tell my friends to speak up about their needs, to ask questions, to invest personal time getting educated, and to share that information with their sons, but also with their daughters.

As we shall see in Part II attracting more women to the financial industry could play a major role in making sure we better address their needs.

*Impact investing: investment strategy intended to generate beneficial social or environmental impact in addition to financial gains

SPECIAL EVENT: We will be hosting a virtual event this fall with a special guest who will present WOMEN: WIRED TO INVEST – Unlocking your financial power. All are welcome! Visit our website: www.EphtimiosMacNeil.com under “EVENTS” to find out more and request an invitation.

Lynn MacNeil, F.PL., CIM®, is an Associate Investment Advisor and Financial Planner with Richardson Wealth Limited in Montreal, with over 25 years of experience working with retirees and pre-retirees. For a second opinion, private financial consultation, or more information on this topic or on any other investment or financial matter, please contact Lynn MacNeil at 514.981.5795 or Lynn.MacNeil@RichardsonWealth.com. Or visit our website at www.EphtimiosMacNeil.com.

The information provided in this publication is intended for informational purposes only and is not intended to constitute investment, financial, legal or tax advice. This material does not take into account your particular situation and is not intended as a recommendation. It is for general purposes only and you should seek advice regarding your particular circumstance from your personal tax and/or legal advisors. This material is based upon information considered to be reliable, but neither Richardson Wealth Limited nor its affiliates warrant its completeness or accuracy, and it should not be relied upon as such. June 2021

Richardson Wealth Limited is a member of Canadian Investor Protection Fund. Richardson Wealth is a trademark of James Richardson & Sons, Limited used under license.

[1] Investor Economics Household Balance Sheet Report – Canada, 2017

[2] Women and Wealth white paper. Strategic Insight 2017

[3] https://www150.statcan.gc.ca/n1/pub/89-503-x/2015001/article/14640-eng.htm

[4] https://www150.statcan.gc.ca/n1/pub/11-621-m/11-621-m2004015-eng.htm

[5] Managing the Next Decade of Women’s Wealth. Boston Consulting Group. April 2020

[6] Women & Finances. Harbinger. April 2015 or Women and Wealth white paper developed by Strategic Insight